Also, your credit score drops if you pay all your debts

Also, your credit score drops if you pay all your debts

Also, your credit score drops if you pay all your debts

fun fact, credit score is not a thing in most of the world.

And didnt exist until 1989 in the US. Credit scores and Tay Tay are the same age.

However if you were a minority or a woman it was also a removed to get a loan prior to it. Though women couldn’t even have their own bank accounts till… the 60s/70s?

Sorry, but Tay Zonday was born in '82, so predates the credit score. (There's only one Tay Tay for me and it's Zonday)

Credit reporting has been a thing prior to that, but yeah, scores are relatively new.

Who?

fun fact, neither is the social credit they complained that china had, but the western credit score is basically a social credit that punish people for not consuming beyond their means.

China social credit started out as something like a credit score where you would get beneficial services/rates with a better score from lenders such as Sesame Credit.

The government took that and applied it to many spheres of the society in a pilot program. I don't know how it is today since I haven't looked into that since 2019.

So when you have some car insurers, for example, that offer to put a gps device in your car in exchange for better rates, this is how the social credit system started through private companies.

You can raise it well without going beyond your means, but then it's a slow and annoying racket.

It's reasonably common in the developed world. And it's a good idea that lenders be able to easily know how responsible borrowers are with repayment. That the US' implementation of credit scores is problematic in some areas shouldn't be used as a blanket dismissal of a credit scoring system.

The US credit score system is from the 60's. Things worked just as well before it existed...

i think that article describes many different systems and grouping them under a concept that's not necessarily related. the us system is definitely an odd man out.

Is credit score in the US the same as social score in China but you are owned by your billionaire instead of the party?

it's actually worse, which is fun

I wonder if that means that borrowers in the rest of the world have to pay a premium when they borrow money because the bank is taking a bigger risk.

i mean there's still a way to mark that someone isn't good at paying their bills. its just not a "score". it's yes or no.

Yeah, credit score is a social rating in the US

Just trolling, Russia has a credit score system

And for anyone in the US, just know that State Farm is one of the worst companies for Homeowners Insurance. They will pay the bare minimum. All insurance sucks, but State Farm is on a whole other level of suck. If you are with State Farm don't make the mistake I made and quickly find another company.

Seriously, leave State Farm. By not leaving I am now paying $20k that they should have covered.

Remember Katrina?

Like a grim reaper state farm is there

Someone t-boned (and totaled) my truck and they had State Farm for car insurance. Everyone involved acknowledged I was not at fault, except State Farm. They wanted to write it off as a mutual fault, which would mean they wouldn’t have to pay for my damages. They also never told my insurance company, because it was news to them when I mentioned it. I just hope my insurance doesn’t go up because of their ineptitude.

Yeah fuck that. Make sure your insurance company is going to bat for you, that's part of what they are paid for. Make it clear you dont expect this to count against you at all because the other driver is at 100% fault.

Shouldn't take much push from them for state farm to fall into line.

I just left a job with State Farm. They also the most expensive and go out their way to fuck you hard.

I got them to replace my roof like 4 years ago, but it was an argument that took a couple of months because they wanted to go around and spot replaced only the damaged shingles. I stayed nice and held my ground that doing so would look bad and thus diminish the value of my home. It was like pulling teeth, but I was able to talk with someone at state farm who felt like wanting me to get my way by speaking nicely without myself being a pushover.

I had them when we bought our house. A tornado game around the second year. They sent me a check for 6k and expected me to get someone to do only half my roof. Took me little over a year and half. Found a guy who did the whole roof for the 6k. I turned in the recipient and pics and they sent me another check for 7k. I said what's this? They said thats what the claim was for. They estimated 12k. I told them if they paid that up front I would have gotten job done a year earlier. Because I gave them a quote I had gotten for 11k. Joke on them I got pocket that 7k, because whole roof was done for 6.

Of course they raised my rates for filling a claim. Which is one of the biggest scams on earth. Insurance is supposed to be the transfer of risk. They are supposed to protect you. But if you file they raise your rate.

Reminds of the story of this old guy. Had AllState for 20 years. Always paid, never had a claim. He gets into a fender bender and he said they raised his rate. He was pissed. Twenty years of monthly payments. Paid in way more than the wreak cost, and they fuck you.

Also State Farm supposed to be a mutual Insurer which means your supposed to get a check at the end of the year for any unused money. Has anyone ever gotten a refund or money off the renewal?

just know that State Farm is one of the worst companies for

HomeownersInsurance.

I wouldn't get any state farm insurance. We had to sue to get the very coverage outlined in the policy for uninsured/underinsured driver coverage.

Just the worst.

Yeah, unfortunately they are the only company that offers insurance in my area. Some times bare minimum is better than nothing.

Who are some of the best? And not USAA. I'm talking ones anyone can apply for.

I have had trial lawyers tell me that State Farm is a pain to deal with even when claims get serious enough to involve them.

I have been using Allstate for a long time, and to their credit they have been good about approving my claims and paying fair amounts.

In the 2010s I had a totaled car one year, then another year I had two homeowners claims: a moderate one to get new siding after damage from some insane winds, then a bigass claim that ended up replacing plumbing and flooring while we ran up months of hotel bills they paid.

I’m not going to delude myself into thinking they’re a good company or give a shit, but my personal experience has been consistently decent.

I don't have state farm but get their offers in the mail all the time. I have a different agency that has covered our home and autos since 1998. That said, when we removed our pool I called to see if we could get a downward adjustment on our home insurance since... we not only removed the pool, we also had a 4.5 foot chainlink fence surrounding our property. They laughed at me.

The real death of America is everyone drowning to death in made up fees.

No kidding! Way back in the 80s I had a US Bank account called "The Only Account". It was a checking and savings account where checking always had a balance of zero. When I wrote a check or withdrew money from an ATM, they automatically transferred money from savings to checking to cover it, and then the checking balance immediately went back to zero and that was that. No overdrafts. Ever. There was an annual fee of I think $20/year.

I don't know where that idea went, but banks and even credit unions now act like they never heard of such wacky nonsense. "Overdraft protection" consists of loaning you the money, no matter how much you have right there in your savings acct, and they charge a fee each time and of course also charge interest on the loan. Ridiculous.

My credit union has this. That feature has kicked in for me a few times for me just this year.

You didn't explain what would happen if your checking account had a $0.00 balance and your savings account had a $0.00 balance.

Seriously can someone tell me what happens? Because money keeps coming out of my savings...

“Overdraft protection” consists of loaning you the money, no matter how much you have right there in your savings acct

That is not universal, many financial institutions let you set it up so that your savings automatically covers overdrafts.

I've had that be the case in my Ally accounts since like 2010 at least, for no fee. Hell, Ally doesn't even charge overdraft fees at all anymore, apparently.

Yeah cuz a credit score measures how good you are at being a credit customer, not how good you are at money.

And is irrelevant to the text above? They said their insurance went up not that their credit score changed.

Wanna take a guess at one of the factors in how much you pay for insurance premiums in most US states?

For people with poor credit, buying a house can be challenging — and expensive. Once you find a lender that’s willing to offer you a mortgage, you’ll probably have a higher interest rate than someone with good credit. And you could also pay significantly more for homeowners insurance.

A NerdWallet rate analysis found that a person with good credit would pay $2,110 per year for homeowners insurance, on average. But in most states, someone with poor credit would see an average premium of $3,620 per year — over 71% more.

The post title directly references credit scores. Its pretty relevant to respond to.

I was replying to OP saying, "Also, your credit score drops if you pay all your debts," not the item they quoted.

You don't need to loan money to get a credit rating, that is a total myth.

The credit rating is based on assets and income, debt actually has very little effect on it, only if you declare bankruptcy does it usually change the rating.

A person with a mortgage will always have a much better credit rating than the same person without a mortgage, not because they have a debt, but because the house is an asset.

House insurance on a mortgage is there to protect the lender, not the homeowner. Its quite likely that paid off mortgage policy holders make more claims than mortgage owners and that would affect the risk rating.

You don’t need to loan money to get a credit rating, that is a total myth.

You're right in that you actually need to be loaned money to get a credit rating, but you're just entirely wrong overall.

The credit rating is based on assets and income, debt actually has very little effect on it, only if you declare bankruptcy does it usually change the rating.

You're objectively incorrect. Please look into what the credit agencies say they use before you provide your opinion.

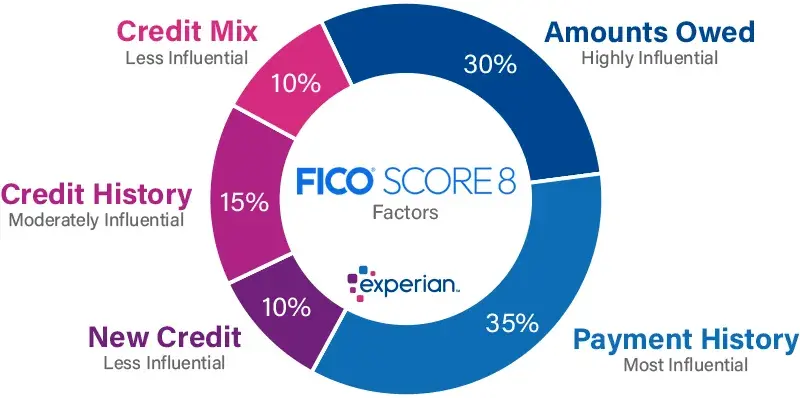

How much you owe and your payment history is 65% of your credit score alone. You literally have to be loaned money to have a credit score.

What you're saying directly contradicts what OP (the headline writer not the post they quoted) said - that paying off your debts lowers your credit rating.

My dad paid off his mortgage and owned his vehicles outright. He had been that way for about 10 or 12 years when he tried to buy a small cabin. Even though his finances said he could buy it outright, he tried to get a small mortgage....the banks REFUSED to give him a mortgage. They said he basically didn't have a credit history. Its all made up bull excrement that screws with peoples lives for the fun of it.

"damn this guys responsible, we won't make a buck!"

If you took 10 loans, paid them all off and never missed a payment on any of them, then you have proven you are safe to lend money to.

If you never took a loan, who knows if you can pay one back.

Yes, it's stupid that being responsible means you are untrustworthy, but it does make logical sense that paying back loans proves you can pay back loans, and not doing so, well, doesn't.

My premium nearly doubled because it's a manufactured house and it crossed the 25 year old line.

Fuckk. Sorry to hear that.

What is a manufactured house? Sorry for the ignorance I’m not familiar with the term. Sorry that happened to you.

You've got nothing to be sorry about! Manufactured homes are built at a warehouse and then are trucked to the property where they're installed. They're built slightly better than mobile homes, but are built fairly similarly. They can come in multiple pieces such as mine that would be referred to as a double wide due to it being two pieces.

They don't follow normal building codes, and in the US they follow HUD codes. HUD codes tend to be much looser. For example the trusses that hold up my roof are really crummy 2x2s that you couldn't use on a regular built house.

The idea is suppose to be cheaper housing, but like pretty much everything geared towards helping the poor in this shit hole they're traps. They're still not very cheap, and they're poorly made. Meaning they'll start to fall apart after a couple of decades. I was lucky enough to be born into a poor but handy family so I can fix my turd of a house as issues come up, but the insurance company doesn't care that I rebuild things beyond code when I can.

Here's a factory: https://youtu.be/jm2SbE9YuEA

Here's an install: https://youtu.be/81WBC6_sahU

American tract houses should be the same way, honestly. From what I’m seeing from home inspectors on YouTube, there’s no way they’d survive transportation but the manufactured homes do majestic fine.

Its crazy, the only debt I've held is student loan debt and I have paid the bill every single month. Otherwise I use checks and a debit card, I had money to buy a used car upfront.

Went to get a credit card. My credit score is below 700, and I was deemed "unqualified" because, get this, I don't have a history of paying off debt, because I have not held enough debt to prove I can pay it off.

My credit rating is so bad that I had to have my brother co-sign a lease for me fifteen years ago. The landlord told him his credit rating was the highest he's ever seen. My brother (and his wife) were in debt up to their eyeballs - over $100K in credit card debt and a mortgage they were deeply underwater on. They're still in bad shape financially; meanwhile I now own my own home outright (having paid cash for a fixer-upper after saving up for a few decades). I still have shitty credit and it's not affecting me negatively in any way.

Just dealt with this. I didn't even exist in the credit system. I've even been told if I had BAD credit I would qualify for something.

Eventually I did get connected to a small local credit union and got a pretty good deal on interest as a 'first time buyer's program.

Now they want you to pay a secure credit card the privilege of having you as a customer, always with a high annual fee and absurd interest rate, and then after a couple years of bleeding maybe they'll give you actual credit. Meh. If you're above 620 you should qualify for FHA first time buyer's loan, which is honestly one of the few ways to not get fucked right now. We're going to do (housing crisis) indefinitely so even shit property goes up.

Yeah, it's dumb, but you should be using a credit card for all your purchases and paying it off every month. I do this, and my credit score is over 800. Make sure you get a card that has cash back rewards so you can get paid for having to do this. Just be extra sure to budget it accordingly and not go into debt.

been playing their game a long time. basically add up credit limit on all your cards. divide by usage %. on time payments and years with good credit, net worth, are factors too. i don't know their equation. sitting about 820 with no debt and 7 lightly used cards. used to play balance transfer until they quit offering incentives. 10k until finally paid down. always pay down principle as fast as you can. saves years of payments/interest. https://www.investopedia.com/ has lots of good reading. think they also sell stuff so.

I use a rewards card to pay for things like service calls/repaires (latest was $650 for a AC repair) I pay it off over a couple months. I could have paid it right away but the rewards give me free protein and gas and that is something these days. I do it in halves to spread it out and leave me extra liquid cash I can withdraw if I need it. I am considering holding about 500 or double that in small bills in case the financial system shits the bed for a few weeks in winter due to the tariffs and economy. Right now, nothing makes sense irt to the markets so I think it is all vibes and denial happening.

Yes my car insurance jumped $100 the minute I paid off my car.

I've found that this is usually a "staying with a single insurance provider" problem. I usually end up switching every two years or so, but I check everytime my six month renewal comes up. I've found that my premiums pretty consistently go down so long as I keep looking around. The last few times I switched from geico to progressive then back to geico, and the cost went down each time I switched.

Fun fact. At the last call to make sure my insurance was switched over properly, I had the csr angrily explain that in order to get the same affect, all I had to do was ask for a reevaluation of my policy. It turns out that the automated systems that send out your new price every renewal don't do a good job of adjusting the premiums down and you're supposed to ask a person at the company to review things if you don't like the automatic price.

I plan on continuing my personal policy of switching providers every few years anyways. I'd rather have the new customer prices than deal with a person on the phone going through every option to see if the new price is actually better or worse than the competitors offers.

I had the csr angrily explain that in order to get the same affect, all I had to do was ask for a reevaluation of my policy

"If it's hurting your customer retention, it sounds like you stupid fucks need a reevaluation of your pricing policy"

Not saying the UK has it right (cos we definitely don't) but the 'loyalty penalty ban' has really helped.

You can't be charged more for staying with an insurer than if you were a new customer.

I do pretty much the same, it does seem like it's usually around the 2 year mark that they try to raise premiums. I may try the policy evaluation thing next time just to see what happens. But yeah, it's always a good idea to look around at other carriers when they pull this crap.

It's your fault for their dumb system you dunce. Ask next time dumdum

Ugh yeah. And I have renters insurance through the same brand. I’ll have to look at swapping.

I've always heard the best way to keep the costs down was to keep switching insurance providers. Unfortunately my wife chose to buy insurance from her high school friend

Just change agents to keep your long term customer discount.

it's your car now, not the bank's. so you can reduce your coverage and lower your premiums. the higher rates are to make sure the insurance company doesn't lower their profits when you drop the 'full' coverage.

Yeah. Between this and the “switch providers” advice I will be looking at it. I am not sure I want to reduce my coverage though. Where I live people are absolutely batshit. I know everyone says this…but I’ve never felt more in danger driving than I do in Connecticut, surrounded by people rich enough to murder me with their car and think of it as an inconvenience.

heh heh I am at the point where my mortgage is paid and I have no CC debt. I have some savings and retirement accounts. But I cannot rely on this since we have the Trump Tariff Taxes. So I suppose I cannot retire this year as I hoped. I have to save more. My dh is 3 years younger than me and really wants retirement... he is a construction union guy so I tell him to make an appointment w/their funds person and we can design a plan. I will likely continue working part time for the next 6 or 7 years to cover healthcare unless the Democrats pull their heads out of their asses.

make an appointment w/their funds person and we can design a plan

"Do you have two million dollars?"

"No."

"Plan to go back to work."

The shitt9est thing about credit is that payments that don't improve your credit can still hurt it when you miss.

Late on rent or your cell phone plan? That's a ding on your credit report. You can't get a loan because you haven't established that you'll pay your debts.

Pay your rent on time for 30 years straight? No credit history. You can't get a loan because you haven't established that you'll pay your debts.

Credit score in Murica is the dumbest thing I've ever heard. You'd think your credit score would be high if you always paid everything in time, were never late and never penalized. Instead you only have good credit score if you're perpetually in debt. Wtf?

Think of it as a profitability index rather than a diligence index, and it will make more sense.

It will also be wrong.

The only credit lines I have and have had for the last 7 years (which is as far back as the bureaus care, at maximum) are credit cards. I pay them off every month, so I'm charged zero interest, and they're rewards cards, so their profit off me is literally negative.

My credit score is over 800.

No offense, but you're misinformed.

You get a good credit score by borrowing money and paying it back faithfully, not by being perpetually in debt. I carry a mortgage but no other debt, and pay off every credit card balance before charges or interest accrue, and my credit score is solidly in the top range.

I know it's a crazy concept, but to be considered a safe person to lend money to, you have to actually borrow it sometimes and prove that you will pay it back.

You get a good credit score by having debt. That's just kind of common sense, because they don't know how to score you until you gain some debt. That part is mostly okay.

The dumb part is when you pay off that debt, such as a mortgage or car loan, your score actually goes down.

I'm never in debt aside from a mortgage and have 1 credit card I use and pay off every month. No car payment ever. Bills are electric, trash, and cell phone. My score is 825. It was pretty high before the mortgage as well.

You'd think your credit score would be high if you always paid everything in time, were never late and never penalized.

That is exactly how it works. That's exactly the situation I'm in, no real debt (only credit cards, which I pay off in full monthly, so no interest) and haven't been since I paid my auto loan off over a decade ago, and I'm in the low 800s, where 750+ is the highest tier in the eyes of basically all lenders.

Instead you only have good credit score if you're perpetually in debt.

Incorrect. I'm astonished at how persistent this misconception still is.

Having an active loan is by its very definition being in debt...

just paid all credit cards to zero, FICO 8 went up 16 point, FICO 9 went down 15 points 🤷

Got a new car loan.

20 points up.

When I was a a young adult, I got a new credit card. The credit check dinged me for 10 points.

When I asked why, and how I can fix it, the credit card company support person said, "Just carry some debt."

I keep my one credit card paid off to 0 every month, have never paid a car loan, only debt I have is a mortgage, and my score usually just floats around 825.

Basically the same for me except no mortgage, and I'm also in the 800s.

Though once you're over 750, you're essentially at the highest tier in every lender's eyes already.

Stop trying to max your credit score. You don't win any extra prizes for having an 850.

Having a good credit score (>670) isn't difficult. Have a couple of cards, keep your balance under 1/3 of the limit, and pay it on time. That's it. You'll have a 700 in short order. Getting it above 750 is just more of the same.

I get that there are perfectly responsible people who don't leverage credit to gain their needs and then are rejected by the banks when they go looking for a 200k loan. But that's not the world we live in. Bill the Banker isn't the guy whose lived in your community for twenty years and goes to your church. That world is gone and had problems too.

This impersonal world sorta sucks, but I'm not close friends with my neighbors and some of them seem like people I wouldn't get along with anyways.

The real rub of it, in my opinion, is we are subject to these standards without being consulted or, really, considered.

But honestly, don't worry about maxing your credit score.

This post is about insurance premiums and has nothing to do with credit scores.

The post is about insurance premiums, but OPs title is very clearly about credit scores

The rest of the comments, on the other hand.

Credit-based insurance score is applicable though with relevant overlap.

Think Lexisnexis instead of equifax/transunion etc.

An insurance score is calculated by insurance companies based on information in your credit report as well as your claims history.

Getting above 700 is quite easy but going above 800 without a car loan or mortgage has been pretty difficult for me and my partner. Credit cards alone even with high limits doesn't look the same to the Bureau's as a mortgage or auto loan for whatever reason.

Problem is that those "non-persons" can't stay in their lane, and have to pollute and disrupt society with their predatory tactics, instead of going to some forest and "pulling themselves by their bootstraps" alone.

These are strangers asking for money. They have no objective evidence that they are a good bet. Why would the bank give them a large loan for a long time?

I wouldn't give that person money and you wouldn't either. Hell, I wouldn't give a lot of people I know that loan. Less about them and more about me.

Credit Score exists to sell you more Credit Score. This seems to have come about as a natural extension of them being required to let you see your Credit History.

It's Credit History that you want, and that lenders check. They may turn it into a score, but that score varies by lender and what you're borrowing for, and frankly they may want more than just credit history anyway if you're borrowing enough to buy a house.

If you don't have any credit history, use a credit card for your day to day spending, pay it off in full each month. As a bonus, you often get extra consumer protections that debit card boys don't get.

Credit scores include credit history and more. Credit scores are used by many lending industries. Credit history is one of the two major factors in determining a credit score. There are two less than major ones and two minor ones. But to reduce credit scores to just history is wrong.

On the topic of the title: In my own case, I didn't even pay all of my debts, all it took was to pay off my student loans. My credit score dropped 30+ points from that and has never recovered since.

And to all the liars who said some variation of "it's just a temporary drop" ... You are liars. That is simply not true, at least not for everyone, and you lied. Maybe consider stop giving advice about things when you're clueless.

And to anybody who might consider listening to those clueless liars, please note that a whole lot of the advice you might read from people online is coming from clueless liars.

Okay, I'll end my rant there.

But... The fuck is the alternative? It's not worth being late on payments to keep a loan open nor is it worth racking up interest if you can pay it off early (*) only because you want to keep a few extra points on your score. ~30 points isn't that serious depending on what your score is. If it's low it can matter more, but if it's higher it doesn't matter too much. It's very rare that ~30 points will make or break you. In short, I wouldn't consider paying extra interest only for my credit score to stay higher.

(*): Depending on the interest rate of your loans it's not always worthwhile to pay off early. Everyone's risk tolerance is different, but, hypothetically, if your interest rate is less than what you can get in a high yield savings account you're better off putting the extra money into savings. If you're risk tolerant then bonds or total market index funds may be a better choice as well. This really gets into the weeds of it, but my point is that ~30 points really isn't worth paying extra interest money for.

My credit score dropped 30+ points from that and has never recovered since.

How much time is "since", and your credit score according to what/who? If it's Credit Karma, keep in mind that its scoring method "VantageScore" 'zaps' a closed/paid off account from your credit history immediately, but none of the credit reporting bureaus work that way, they continue to consider the paid off loan with respect to account age/etc. for a number of years afterwards.

Based on how the blanks are filled in above, you may have your fair share of "clueless", so I wouldn't be so hasty to call people "clueless liars" (not to mention that if someone is wrong because of lack of knowledge, that by definition is not a lie).

I would love for each person living in the USA to reach zero debt. It would probably collapse the damn system. It’s ridiculous how much of it relies on you having debt and some stupid credit score.

It's not stupid, it's actually an ingenious way to rig the system to keep the siphon tapped into poor people's bank accounts.

When there's something about the model that doesn't make sense, find an alternative model where it does. It's often quite enlightening.

In the case of credit scores, the model you're probably thinking of is that following all the rules as written should make your credit score go up. But this is not the case. A better model is that credit score tells the bank how much money they can get out of you. They make more money from someone who is late every once in a while. That model is more consistent with reality.

that credit score tells the bank how much money they can get out of you.

This is the whole game, right here. It's their score for how they see you, with respect to exploiting your desire to purchase things, to make money. And to be clear, a big part of that math is how much interest you're likely to pay. If you keep paying things off, and don't usually carry a lot of debt, you're not as profitable a customer. The more you tend to pay interest for things, the higher your score.

Interestingly, a lot of this is not halal. Which means that Muslim banks have some creative workarounds for lending and helping their communities out. While I've never done this myself, it sounds like folks around here might find that an appealing alternative.

After reading a good number of replies the thing that amazes me is that US banks aren't on fire right now.

I’m trying but those sprinklers are really strong.

You have to get the molotov behind the curtain

I have only one credit card which I charge everything to (credit limit is more than enough at over $10k) and which I pay off in full each month and have no absolutely debt, therefore my credit score is absolute dogshit.

Keeping a mortgage is also used as a tax write off. So a lot of people who could afford to pay off their homes don't because of that as well.

I'd like to see the math on that.

That’s because it’s generally false. It’s only correct under certain circumstances like being in the house flipping game, etc. and likely requires you to have a tax lawyer.

Paying a mortgage generally costs more than the deduction.

So... I have a guess as to why this is. It might be entirely wrong, but it kind of makes sense to me. I would bet the bank also partially insures your home when they hold your mortgage, and so the two insurers/policies split the liability in that case. When your mortgage is paid up, the bank no longer has stake in the home and doesn't insure it anymore, meaning the full liability falls on your insurance policy alone now. So they likely raise your premiums to account for the hightened risk on themselves. That's not necessarily a justification and it obviously sucks for you, but, it does make some amount of sense IF my guess is correct.

Either way, paying off your mortgage is a big accomplishment and removes a big burden from your shoulders. So kudos on that at least.

My guess would be that it is a proxy for income. As far as i am aware credit bureaus do not have access to information about how much a person earns. However if you are paying off a $2k mortgage each month, then the assumption is made that you have either enough funds or income to afford it. Once you pay off your loan it becomes a black box again, as there'd be no way of telling whether or not this is still the case.

Makes sense to me, but from the opposite direction. In a capitalist market, the price of things is whatever customers are able to pay for them, not what it costs to make them. Everything above cost is profit. (If the cost is higher than what customers are able to pay, then the thing is simply not made.)

If the insurance company knows you've just paid off your mortgage, that means you now have an extra $2k a month in disposable income. You are able to pay for more things, OR pay more for the things you have, therefore this is the best time to raise the prices on you, capture that income back to the insurance company. Short of government regulation dictating specific insurance prices, they will do what's in their interest.

In a truly free market with infinite competition, one insurance company couldn't raise prices arbitrarily because any other would swoop in and undercut it. But when insurance is an oligopoly composed of only a few companies, they can all just raise the price on you all at the same time. Plus, switching insurance is laborious for you.

Could be something like that too, yea. Getting a mortgage means the bank, which does know your financials at that time, approved of the loan, and then continued payments without delinquency would indicate that your finances have not made a turn downward.

Canada has credit scores as well... is this a thing here too?

Apparently we have them in the UK but I have never had a reason to care. I intend to keep it that way.

We know you're good for themoney now you don't have the extra outgoings!

Anecdotally I haven’t found this to be true. I’ve had mortgages, car loans, etc and times in between without debt. Credit score never really wavered more than 10-15 points.

Gotta g get that $ somehow

You can't make this up

Makes it up.

Maybe they were saying that you can't make it up, but they can because they are more imaginative.

Can you please not repost X content on lemmy?

"You can't make this up"

-Someone who wants you to take them at their word for an outrageous claim while providing no supporting evidence whatsoever

What are you talking about? Its not outrageous at all. There's countless stories of exactly this happening and yes others have provided proof some even have videos about it im sure.

Maybe I don't like people imposing on my freedom to make things up by telling me that I can't make this up. God, this is like MC Hammer all over again!

That's a personal issue...

If the insurance determines you as an adult individual to be less responsible than you and the lender, then you're gonna pay more.

In rare cases you pay less

But it's likely more to do with them getting the house reappraised at a higher value once it sold. But there's a lot of things that effect it.

things

Yeah. capitalism is a disease

You know, you don’t have to pretend that the obviously bad things of the thing you like is actually good because you like the thing?

The value of the house is not gonna go up because a few decades went by by which time they paid it off; it would only decrease by that fact! And the only thing we know about her is, that she paid her debt off… You find that irresponsible of her?

The value of the house is not gonna go up because a few decades went by by which time they paid it off; it would only decrease by that fact

That's hilarious

The value of the house is not gonna go up because a few decades went by by which time they paid it off; it would only decrease by that fact! And the only thing we know about her is, that she paid her debt off… You find that irresponsible of her?

I honestly can't tell if you're trying to be sarcastic, or genuine...

The value of the house is not gonna go up because a few decades went by by which time they paid it off; it would only decrease by that fact!

Nearly all houses that are maintained well appreciate if they weren't overpriced when you bought them (or world crisis doesn't intervene). I bought my small starter house at $135k and sold it 17 years later for $245k.