Reddit Insiders Selling Days After IPO; Shares Fall

Reddit Insiders Selling Days After IPO; Shares Fall

CEO Steve Huffman and others disclosed sales days after the IPO.

Reddit Insiders Selling Days After IPO; Shares Fall

CEO Steve Huffman and others disclosed sales days after the IPO.

He sold about 500,000 shares. He owned, apparently, 3.3% of the 17.06 million total shares of the company, meaning he had a little over 562,000 shares. He sold almost all of his shares. That doesn't exactly exude confidence in future growth, IMO.

Sounds like something a greedy little pigboy would do

Lol, if only someone, or like, thousands of someones, warned the others and this. Shame. Anyway...

ahahahahahahahahaha

Spez proving almost everyone else right.

On the other hand, he already cashed out once and was wrong, so...

https://en.wikipedia.org/wiki/Steve_Huffman

The site's audience grew rapidly in its first few months, and by August 2005, Huffman noticed their habitual user-base had grown so large that he no longer needed to fill the front page with content himself.[11][14][15] Huffman and Ohanian sold Reddit to Condé Nast on October 31, 2006, for a reported $10 million to $20 million.[3][16] Huffman remained with Reddit until 2009, when he left his role as acting CEO.[17]

Huffman spent several months backpacking in Costa Rica[18] before co-creating the travel website Hipmunk with Adam Goldstein, an author and software developer, in 2010. Funded by Y Combinator,[19][20] Hipmunk launched in August 2010[21] with Huffman serving as CTO.[22] In 2011, Inc. named Huffman to its 30 under 30 list.[22]

In 2014, Huffman said that his decision to sell Reddit had been a mistake, and that the site's growth had exceeded his expectations.[23] On July 10, 2015, Reddit hired Huffman as CEO following the resignation of Ellen Pao[24] and during a particularly difficult time for the company.[25] Upon rejoining the company, Huffman's top goals included launching Reddit's iOS and Android apps, fixing Reddit's mobile website, and creating A/B testing infrastructure.[3]

Since returning to Reddit, Huffman instituted a number of technological changes including an updated mobile site and stronger infrastructure, as well as new content guidelines.

I don't think that he's had a whole lot of faith in Reddit as a business since early-on.

Huffman’s top goals included launching Reddit’s iOS and Android apps

Mission accomplished! Those undeniably shitty apps definitely were launched.

Then he wasn't wrong. Never has made money.

According to the second link, he sold nearly all of his class A shares, but none of his class B shares. His total share of the company went from 3.2% to 2.6%, which, is still not insignificant.

I thought they paid him like $200M last year? How does that work out with only half a million shares?

It doesn't, he had like 4.6 million shares before the ipo. The 500,000 number sold is just his class A shares. He'll still have 4.1 million shares of class b stock after this it looks like. The class b stock has ten votes compared to one vote for class a stock for any shareholder votes I believe. So selling only his class a shares won't change the percent voting control of the company he has by much. The person you're replying to is confused about how many total shares he has. I don't think the class b shares are being openly traded though, I think the ipo is just offering class a shares, which is what's causing the confusion here. He sold almost all of his class a shares, but still has plenty of class b.

they paid him a million and change iirc, the rest was stock options

That's weird, I thought the majority of the $150m or so he got last year was in stock. And this says he barely cleared 1/10th of that with this sale.

Edit: nevermind, explained in other comments

Question: why was Apollo killed?

Answer: Spez wanted $16 million dollars

It was not just Apollo, there were other good clients too like Sync for Reddit.

Absolutely. Although, of the 3rd party developers, Christian was probably the biggest thorn in Spez’s ass. Homie’s Apollo developer update posts were legendary and were covered by international press.

So, at some point, Reddit was going to have to be generating a return. Spez or no spez.

I don't particularly like the route they took -- killing the third-party clients was annoying and I think that there were ways to be a profitable super-forum site and still have third-party clients. But it was gonna be something, and whatever they did -- more ads, selling data on users, only providing some functionality to paid users -- was gonna be unpopular.

I would have been ok with reasonable prices for API calls. Bandwidth has a cost after all. But they so obviously set out to drive the third party apps out of business so they could sell ads in the official app/website it just disgusted me.

Also that new mobile site is so shitty, I refuse to believe it's not on purpose.

This is your brain on Capitalist Realism.

Honestly, the things that really pissed me off were

I've given up on buying stocks for individual companies. I'd rather just stuff it in an index fund and pretend it doesn't exist for 10 years.

the average person usually doesnt beat the average index fund, so if you arent keen at day trading, dont do it.

No one is "keen" at day trading, some people get lucky and think they're talented. The vast majority lose money because the big players make sure of it.

What if I'm not average. I bet I can lose all my money. Take that index funds.

I quit trying to day trade ages ago. I put my bigger investments in indexes or companies I think I'm more familiar with than "wall street" and usually long term hold.

If you have the money to spend/blow, the "correct" approach is to:

But if you don't have money to "throw away"? Do not buy individual stocks. Or crypto. Or anything other than what you need to have a life after you age out of the workforce because late stage capitalism.

My one-off is still GME. Diamond hands.

The thousands of rounds of ammunition I purchased during the height of covid has gone from 32 cents to 42 cents per round.

Me too generally. But on a whim i bought 100 shares of NVDA back in 2019, and god damn has it been good so far.

Preach it loud and wide.

I mean only because it's a scam, like a rigged casino (I know the rigged is redundant)

That's advice I've been given many times in my life. If I had any money to invest, that is likely how I would do it.

Most of my etfs are doing better than my stock purchases, but I have had a couple big wins over the years. I'm expecting my reddit put options to be another, though.

Didn't know da brutal yet kunnin' boss of bosses was also a shrewd investor

Do ya have any teef in da shiny choppa index?

Aaron Swartz would loathe what Reddit has become.

RIP

Hot take is I don't think anyone should care about Aaron Swartz. He didn't do anything for Reddit in the merger and left without doing anything for Reddit so who cares. He then died being a martyr for a cause barely anyone cares about and his death didn't inspire any change to education publication/copyright. Nobody should care.

Edit: you can downvote me all you want but I would like someone to comment on 1 thing Aaron contributed to Reddit. Why should anyone remember his name other than 'but he killed himself for the cause bro'.

I think you have to convince everyone why it is reasonable that you are so angry and hateful towards someone you never knew.

He was also a libertarian techbro who thought 'child pornography isn't necessarily abuse'

In the US, it is illegal to possess or distribute child pornography, apparently because doing so will encourage people to sexually abuse children.

This is absurd logic. Child pornography is not necessarily abuse. Even if it was, preventing the distribution or posession of the evidence won't make the abuse go away. We don't arrest everyone with videotapes of murders, or make it illegal for TV stations to show people being killed.

https://web.archive.org/web/20090719140727/http://bits.are.notabug.com/

Are you saying almost no one cares about open access to scientific publications?

deleted by creator

From my experience, these people have lots more shares than what they sold. And aside from spez, it's not really that much.

If I am not mistaken, these sales are also planned and public knowledge before the sales are executed. The key shareholders should know executives are going to dump stock.

But yes. This seems normal to me.

One thing of note is the average price spez sold for. That is actually below market value so it's likely that his sale price was fixed, which I believe is a thing.

Yes. Insiders with that high a fraction of ownership exercise the ability to sell shares at a predetermined percentage value of a full priced share. Usually pegged to the closing price at the beginning or end of a quarter, whichever is lower.

I hate these fucking people so much.

At least they are destroying their own place, now lets hope they just become rich nobodys and keep their greedy fingers of everything else.

I don't. Such as the nature of living in the conservative fascist multiverse.

You cant expect everyone to stop wanting to crush the weak just because you were born in a era of unprecedented technological advancement. Feudalism is still alive and well in some parts of the world, and it has been going strong throughout human history. For all we know, it will outlast democracy.

We are cavemen and cavewomen with space ships and computer phones. Stop having such high expectations for us dumbasses.

Some of these people have been with Reddit since the very beginning and this is basically their first practical chance to sell any of their shares - I wouldn't read too much into their activity this week. For a company valued at $9B, having the founder & other executives only sell $41M in the week of the IPO if anything feels like the opposite of dumping.

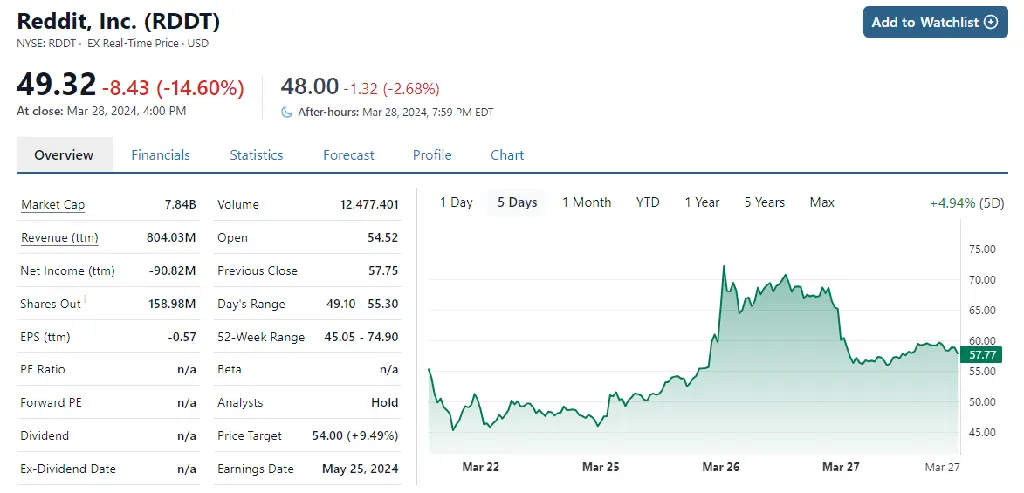

I was thinking short sellers looking to profit would buy up as much as they could to make a bubble then short sell once the market started going sideways, and this chart seems to accurately reflect that:

deleted by creator

First the pump, here comes the dump.

Short!

My bet is the company winds up around a $2billion market cap after dipping to $1.5.

Shares "dove" to $50, which is still about $49 too high

Anything that keeps them listed on the exchange is too high honestly

If you want to have a laugh at how ridiculous the whole market is, Trump's Truth Social just IPOed and has the same market cap as Reddit even though it's much smaller and full of insane people.

To be fair, Truth Social has a userbase who have proudly declared that they are rubes ripe for further grift.

What!?

Of course it should be valued that high!

Totally good indicators of

Estimated 5million total users

3.5m revenues

49m operating expenses

Worth it!

/Sarcasm

Gee it is almost like completely alienating your user base is a bad for profits?

They dumped $50 million the same week as the IPO? Talk about confidence in your company!

Also, they didn’t have any lockout period? That’s also bullshit. I worked for a company during an IPO some years back and nobody could sell their shares for something like a year!

My company is planning on IPO ina year or so, I think we're taxed 50% if we sell early.

I'm pretty sure that's normal capital gains stuff though?

Oh my gosh! Who could possibly have foreseen that?

Shocked, I say!

I won't lie, I do regret not making a quick buck off of it. I could have gotten in at 30-something and out at 40-something easily enough.

I just couldn't stomach the thought of buying RDDT. I also guessed Pigboy Spez and his pals would leave us suckers holding the bag.

Turns out some brave peasants did make money on the IPO. Just not this peasant.

I suspect the stock will spiral down from here.

Meh. Hindsight and all that.

People said it about Apple, Amazon, and Bitcoin. Can’t know which ones that will happen with and which won’t.

I didn’t want to tie my user name to my real life details for that payoff.

Same here! I gave them a fake email and didn't want to do myself to them. Glad you brought that up.

There are no guarantees an IPO will pop, even a buzzy one. Uber debuted at the low end of their estimate and trended downward, for ex, and didn't recover for over a year.

My instinct was that there would be irrational exuberance for the stupid stock. And ignored it.

The market is often pure speculation and gambling until the sobriety kicks in.

Anyway, I missed out on this one because of my caution and contempt for reddit. No point crying over it.

I thought about it, and I refused on a moral ground to support reddit. It still may go up, despite everything.

Rich people don't usually have morals... That's the difference between us and them.

I bought put options on Monday. So far the stock is doing exactly what I thought it would do. I expect to see it at 25 a share before they expire in a few months.

I've got a single $35 p for 4/19. Didn't wanna go too nuts, I've seen plenty of shitcos reach ridiculous valuations after IPO like DASH, and then lose my ass buying puts waiting for the drop everyone knew was coming.

I was pretty confident this was going to follow the same path like what robinhood did when it went public and I threw a bit of heavier money at my confidence on it. Mine are $40 put options that expire mid July. Should be enough time to bottom out on the stock price before it starts to rebound and settle at closer to where it should be. Hoping to triple up on profits. Reddit owes me for the massive amount of ai data from comments I gave them. Lol

Be sure to keep track of your expected price change vs theta lost. Often selling earlier is just as good, after a quick move with higher volatility

Anyone who bought that shit deserves to lose all their money.

Nothing made me wanting to spend time and effort generating free content more then the IPO.

Make your own damn money.

Man I wish I had had the capacity to short the stock so much.

Spez will probably quit within a year or two.

I feel like he is Ellen Pao-ing himself now.

His purpose is to implement all of the unpopular shit, take off with his golden parachute, and then a new CEO steps up promising better mod tools and maybe better performance in the mobile app. They'll make the users think Reddit is headed in a positive new direction with Huffman gone, even though all of it has been preordained and effectively nothing will change, but at least the users will have their bread and circuses.

Problem is Pao cracked down on the toxic hate shit that was making Reddit risky to invest in. It was controversial but ultimately a net positive for the community. Huffman is essentially selling seed corn by betraying developers and power users for short term gain (unfettered bot traffic, juicing native app usage, selling out to AI companies). A net loss for community morale and cohesion.

deleted by creator

Not only is bread not free, but it has increased 20-30% in price.

That's why the circuses have to be so ridiculous.

Trump vs Taylor swift? The writers are getting lazy...

Rats cashing out before it swirls down the drain

IPOs are cash outs these days

Wait, there was no (or a very short) lockup period????!??!?!?!

Tremendously special rules for tremendously special people.

His 500,000 class a shares were a part of the ipo offering, so they were directly sold with the ipo. He still has 4.1 million class b shares which have greater voting rights than class a shares. So the people in this thread saying he's sold all of his stock aren't correct, though he did sell all of his class a shares that are being traded in the public market for the ipo. It's all in sec filings as part of the ipo. You can see here who sold as part of the ipo and how much, and where all the ipo shares are coming from. Some were created to raise money for the company, others were already existing shares being sold by those who already held shares before the ipo. They wouldn't be able to sell after the market actually opened, that's where lockup periods come in, and it's 180 days in this case. The sale price of these shares was negotiated as part of the ipo before it was trading on the exchange. Now any still held are locked up for that period.

They wouldn’t be able to sell after the market actually opened, that’s where lockup periods come in, and it’s 180 days in this case.

That must be part of the amendments then, because when I looked at the Reddit S-1 about three weeks ago, the lockup for all share classes was at three days, very brief. I looked it up specifically because I wanted to know how soon Spez could get to the dump part of the pump-n-dump, and here we are.

It’s a scam, regards.

There is no ethical consumption under capitalism. Especially the consumption of free labor from commentors and moderators.

Wow it's almost like we called it

You didn't have to be a stable genius to predict that..

What an unexpected outcome! Who would’ve thought.

Smallest violin, where are the insufferable hodl guys now?

r/wallstreetbets strikes again!

One of the only reasons I am ok with Reddit still existing.

I hate to say it, but Reddit might be primed for a short squeeze. Everyone is shorting it because it is such a turd.

Lots of people, including me, foresaw that.

lol. Get rekt, Reddit

Lol.

Reddit CEO Steve Huffman sold 500,000 shares on Monday at an average $32.30

On Monday the 25th, Reddit shares were trading between ~$49 and ~$59. The stock has not yet dropped below the initial price of $34.

Can somebody explain why these shares may have been sold below market value?

There's a bunch of trades which happen instantly when you IPO. I don't know exactly how it works, but I think that when my company went public the pool offered in the IPO included stock from priority shareholders. So I'm guessing he effectively sold them to reddit at slightly below initial offer value for them to release to the public as part of the IPO. This way he doesn't tank the stock by selling off 500k shares on the stock exchange.

You're exactly right, he sold off all his class a shares as part of the ipo, though he still retains 4.1 million class b shares that have greater voting rights. You can see who sold shares as part of the ipo with the sec filings:

In the table there in the middle you can see how many class a shares were sold as part of the ipo and where they all came from, 500,000 were from huffman. So all the people in the table there sold at the ipo price (or they were new shares created by the company to raise money), they were not sold at the price it was later trading at in the open market. They were already bought by then as part of the ipo. He wouldn't have been able to do that anyways, I see a lockup period of 180 days listed.

He borrowed money on Reddit's books. Reddit used that money as part of the IPO. Then he sold his shares, and got his hands on the now clean cash money. Reddit is left with the debt? Is this about right?

Oh no it's only up 40% since their IPO 3 days ago :(

Heavens knows pre IPO lockup expiration won't be distinctly negative, that's unheard of.

is there a way to do the opposite of to the moon GME? What's the opposite of that? Crash & Burn 🪨🔥🪨🔥🪨🔥

I think that would be shorting the stock, which is financially betting against their stock. It's worth mentioning that shorting a stock has potentially infinite risk.

Fuck that utter hurensohn.

Wait, what’s “reddit”? Is this something i’d need the internet to know about?

Oh. Oh no. How tragic.

Uh.

.... Anyways.

Yeah totally didnt see that coming /s

So much confidence in Reddit's potential! hope it burns down very soon.

This is how the prices new tech IPO’s have always gone. Surge on opening, then huge drop and then sometimes if they’re lucky a VERY slow rise back up. With a stock like Reddit everybody expected a pump and dump from the WallStreetBets people that made GameStop famous.