-

Made In China 2025 - 10 Years On - Was Trump Wrong?

www.imd.org Made In China 2025 - 10 Years On - Was Trump Wrong? - I by IMDChina's self-reliance, innovation & resilience under 'Made in China 2025' continue to shape its global role amid geopolitical tensions & policy challenges.

-

Economics myth explodes: China's socialism innovates better than Western capitalism

YouTube Video

Click to view this content.

-

What economic consequences could there be if the Big Four declare bankruptcy?

In this scenario, the Big Four (Deloitte, EY, KPMG, and PwC) went bankrupt because major companies had accounting scandals. But the Big Four were also directly and indirectly involved, so their licenses were suspended and they could not accept new clients because of the scandal.

But the scandal is causing Big Four (Deloitte, EY, KPMG, and PwC) customers to leave for fear that it will also affect them. The Big Four's finances are in jeopardy and they are declaring bankruptcy to prevent the problem from getting worse.

I would like to know what economic consequences this event could cause, and if this event could be comparable to the crisis of 2008, 1929 or more serious than the two mentioned above.

-

While US builds walls, China ripping them down

asiatimes.com While US builds walls, China ripping them down - Asia TimesThe United States is threatening to impose tariffs on its major trading partners. In the meantime, China is consolidating its position as the world’s

- www.ft.com Japan warns over threat from China’s chip material export controls

Officials and executives say gallium rules will upset supply chains for chips and vehicle batteries

https://archive.ph/ZTboj

-

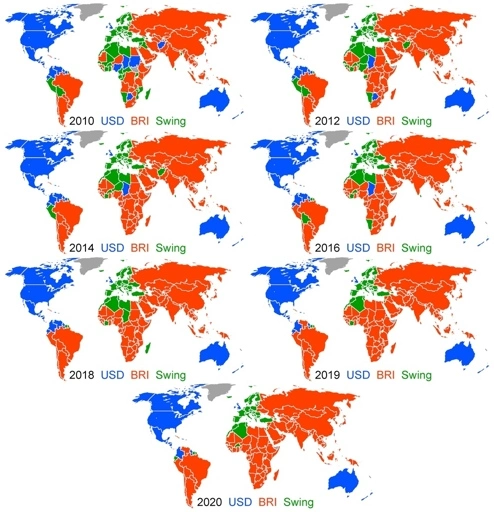

This one simple chart explains why Trump's tariffs are doomed to fail.

China is the bigger trade partner for majority of the world. All the trade war will accomplish is to further isolate the US and its remaining vassals.

https://www.mdpi.com/1099-4300/26/2/141

-

The politics of gold: Economist Michael Hudson explains why gold’s price is rising so much

geopoliticaleconomy.com The politics of gold: Economist Michael Hudson explains why gold's price is rising so much - Geopolitical Economy ReportWhy is the price of gold rising fast, breaking records? Economist Michael Hudson explains politics of the precious metal and US dollar system

-

“Quantitative Easing with Chinese Characteristics”

dissidentvoice.org “Quantitative Easing with Chinese Characteristics” | Dissident VoiceChina went from one of the poorest countries in the world to global economic powerhouse in a mere four decades. Currently featured in the news is DeepSeek, the free, open source A.I. built by innovative Chinese entrepreneurs which just pricked the massive U.S. A.I. bubble. Even more impressive, howe...

-

Trump orders creation of US sovereign wealth fund

cross-posted from: https://lemmy.crimedad.work/post/321458

> I don't underestimate our Dear Leader's ability to do it badly, but isn't a sovereign wealth fund typically a good idea?

-

Capitalism's Overproduction Problem: A Primer

www.hamptonthink.org Capitalism's Overproduction Problem: A Primer — Hampton InstituteBy Prabhat Patnaik Republished from Monthly Review . It is in the nature of capitalism to have “over-production crises”, i.e., crises arising from “over-production” relative to demand . “Over-production” does not mean that more and more goods keep getting produced relative to deman

-

Potential tariff impacts on China shrink as trade routes shift to Global South and BRICS

YouTube Video

Click to view this content.

-

China's New AI Just Tanked US Stock Market

YouTube Video

Click to view this content.

Relatedly, eight months ago: Google “We Have No Moat, And Neither Does OpenAI” Leaked Internal Google Document Claims Open Source AI Will Outcompete Google and OpenAI

-

The Unwinding of Japanese Carry Trades: What It Means for You

sjb-global.com The Unwinding of Japanese Carry Trades: What It Means for You | SJB Global | Financial & Pension ExpertsUnderstand the impact of the Japanese yen carry trade unwind on global markets and your investments. Learn how the Bank of Japan's interest rate hikes are affecting currency strategies, market volatility, and long-term investment opportunities. Stay informed to make smarter financial decisions in th...

-

Nvidia and the contradictions of capitalism

Nvidia was propelled into becoming a titan of the hardware industry by the frenzy in the AI market. However, an unstable market driven by a speculative bubble is not a sound foundation. We can get an idea of what Nvidia can expect going forward by looking at what happened with Cisco during the dot-com bubble.

Cisco thrived as the backbone of the internet revolution, supplying networking equipment to a wave of startups and tech companies. But when the bubble burst, the contradictions of capitalism came crashing down. Overproduction led to a glut of hardware, bankrupt startups flooded the market with second-hand equipment, and demand for new hardware evaporated. Cisco quickly went from being a star to a company facing serious financial troubles.

Nvidia finds itself in a rather similar position today. The AI boom created a massive demand for GPUs, with VC funded companies investing billions into hardware. All of a sudden, DeepSeek disrupted both the need for Nvidia's hardware the whole AI as a service business model. When the bubble bursts, the market will be flooded with second-hand GPUs, driving down demand and undermining Nvidia's core business.

This is the essence of capitalist contradiction: the system’s drive for endless expansion leads to overproduction, while its reliance on speculative markets ensures that demand is inherently unstable. Both Nvidia's dependence on high-risk AI startups and Cisco’s reliance on dot-com companies illustrate how pursuit of profit creates fragile ecosystems that are vulnerable to sudden collapses.

The broader implications for the industry are equally damning. Companies that have invested heavily in expensive GPUs may pivot to new paradigms, leaving Nvidia with reduced relevance in a transformed market. Nvidia's current valuation, inflated by AI hype, could face a sharp correction as growth slows and the second-hand market undercuts new sales. Other players in the AI hardware ecosystem, dependent on Nvidia's dominance, could also face fallout, further destabilizing the industry.

This scenario isn't an isolated case of one company’s potential decline, it's a microcosm of capitalism’s inherent flaws. The system’s reliance on speculative booms, its tendency toward overproduction, and its inability to plan for long-term stability ensure that crises become inevitabilities. Nvidia’s trajectory, like Cisco’s before it, is a product of a system that prioritizes profit over sustainability, and short-term gains over collective well-being.

The cycles of overproduction and collapse will continue as long as the pursuit of profit remains the driving force of economic activity. The only way to break free is by building a new system based on rational planning, collective ownership, and the prioritization of human needs. Until then, the crashes will keep coming, and the working class will continue to pay the price.

- www.al.com Alabama faces a ‘demographic cliff’ as deaths surpass births

More people have died in Alabama than have been born since 2020. But the state's population keeps expanding.

Supply and Demand.

If there is no supply of good public infrastructure, inclusive institutions, good governance, etc. people will go elsewhere.

And also, lol.