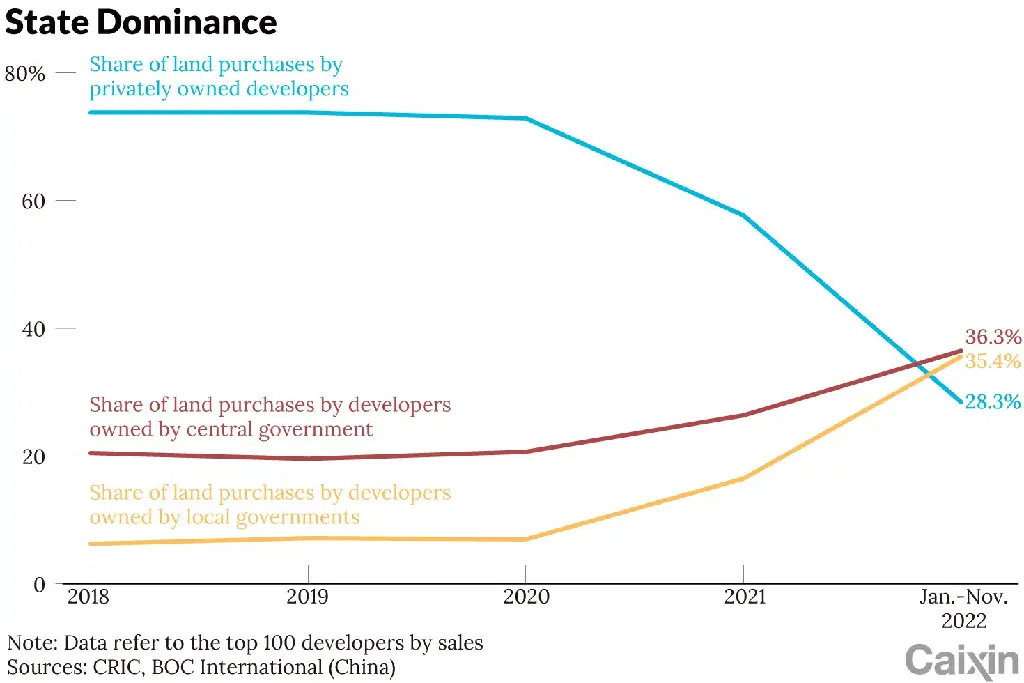

There's a high percentage of Chinese workers that invested their savings in real estate instead of having a pension. And there's no welfare, which means a lot of people who will be left on the street when they are too old to work.

After a complain, I did some research so I can provide enough clarity on my statement:

- A new pensions system was built on top of the previous communist system (19861990s), then in 2004 the gov added enterprise annuities and finally, an IRA system was launched.

This last part was launched in 2022, which finally covered about 1.05 billion people. - There is though a difference in which plan can someone join, depending on their residence permit (either rural or urban).

The residence permit doesn't have a link to where you live, so a rural hukou won't become an urban hukou just for moving to the city. - Why does this matter? Well, an urban hukou will get about $461 US dollaridoos, while the Old-Age Insurance for Urban and Rural Residents plan (entirely used for rural residence permit holders and unsalaried urbant residents), it's about $25 US dollars and a smile.

The why enterprise annuities didn't work (0.25% of companies enrolled) is a very complex one but let's say is mostly due to the abnormally high statutory pension contribution rate.

So up until 2022, a little more than 500 million people had few options for extra savings beyond those $25 dollars/person, and that was real estate (you know, the thing that always goes up).

With IRAs now, and a possible conversion from the two main basic pension plans into a centralized one, it's possible newer generations will have a foothold for a safer savings method, however there are several challenges on the horizon:

- All the economic turmoil of COVID-19, foreign firms moving out, pandemic lockdowns, etc.. is making it harder to strengthen the pension system.

- Demographic issues and high youth unemployment.

- Runs on small banks.

- Recent cuts on local health care benefits.

- The statutory pension contribution rate was lowered, but is still about 16% Iirc. This means though the pension bags are getting 4% less full every year.

Altogether this could very well be a ticking time bomb.