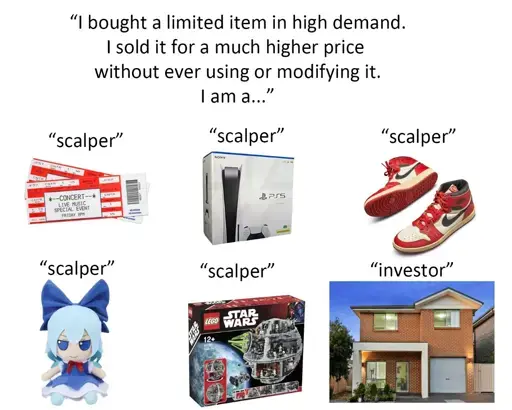

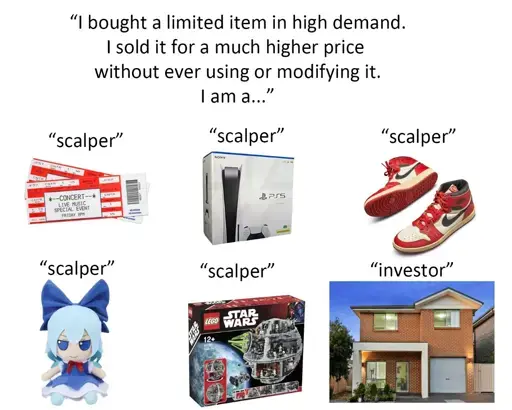

Scalper economy

Scalper economy

Scalper economy

You're viewing a single thread.

I think most of you are underestimating the cost of housing maintenance. We had some bad luck and a couple of structurally necessary renos were bigger than initially thought, or didn't address the issue as well as we hoped, requiring new renos. In the last 20 years we've paid the cost of our townhouse apartment once over, easy. And now the bathroom, kitchen, and flooring could use an upgrade (25-50 years old), which is again expensive. In that time its value has risen maybe 50%, not quite keeping pace with local inflation.

Not complaining, we bought it for living in and it's been great for that, and now that everything is at the end of its lifespan is a good time to really make it ours. But house prices aren't rising insanely everywhere, house upkeep isn't free (there are always "modifications"), and at least here the average ROI for being a landlord is abt 4-6%, same as stocks lately, and that's assuming no major surprises.

If you only own one house, it sucks to have luck like that. But, it’s like the dips in stock prices - overall, the value of the whole market goes up over time. Those treating homes as investments tend to buy in the demand areas, where a few lofty renovations don’t dent their bottom line.

If you get an investment house you plan to keep for 20+ years, those in-demand areas change (here's hoping the next areas to lose their lustre will be the car-dependent suburbia).

Not sure I see the relevance. Yes, housing maintenance costs money, what's the relevance? Who says housing upkeep is free? What's the relevance to anything at all?

"Sold it for a much higher price without ever using or modifying it." Proper upkeep over several years counts as "modifying it" in this context IMHO.

You can indeed make money by selling it at a higher price without ever using or modifying it, and even if you do use or modify it, profits from the sale still come directly from not using or modifying it.

Don't buy something meant to be used and insist you must make a profit for not using it. Rent it out at least.

Yea, absolutely, hence the approximated 4-6% return on investment - some years more, some years negative.

There is this apartment that I've been eyeing for a while, and I've seriously considered becoming one of those loathed landlords myself. Feels like trying to do right by the apartment and by a tenant would be putting out more good to the world than a passive stock fund, you know? So been reading up on it quite a bit lately.