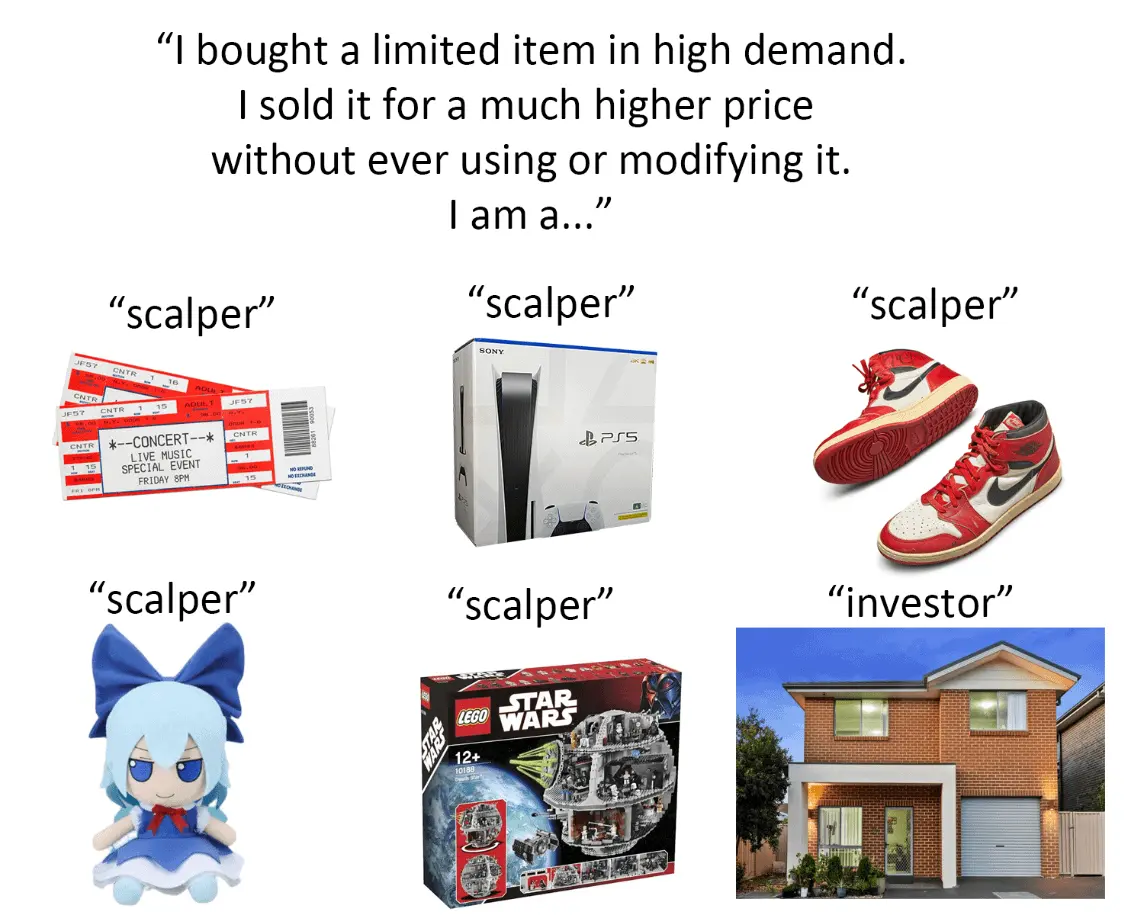

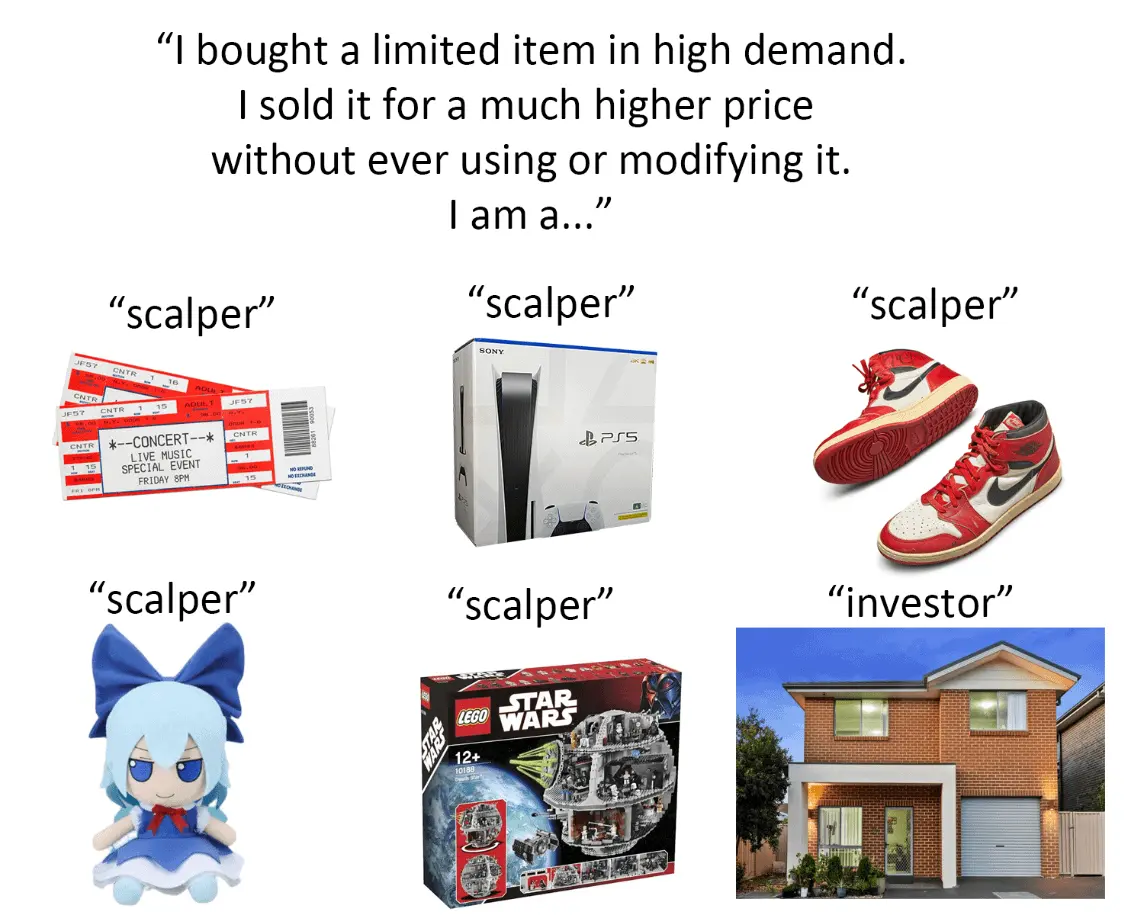

It's just business

It's just business

It's just business

You're viewing a single thread.

I think the difference with the first 5 is that a manufacturer sets the price, scalpers purchase it by that price and sells it at a much higher one.

The house price just fluctuates continuously and when the "investor" or "scalper" purchases it, it was available at that price for everyone (or did he purchase it from another scalper?)

Yes, the problem is the high prices of houses, but to reduce it we need to either increase supply (encourage building more, perhaps changing zoning laws to allow more homes etc) or reduce demand (increase interest rates (that though make it harder for regular people), restricting corporations from purchases, banning Airbnb (yes, they drive prices up, and if you use them, you are contributing to it), penalizing if unit is not occupied (though enforcement of this will be hard), or banning foreign investors.

Land. Value. Tax.

Value.

Tax.

It’s wild that you don’t see how exploitable such a tax would be. Specifically, it would make gentrification occur more easily and quickly.

If a developer became interested in rebuilding a poor neighborhood, their interest alone would dramatically raise the land value of the area. The now untenable tax burden would force the current residents to move out, and because the developer would be the only one interested in buying, the developer has nearly complete control over the sale price.

Developer is not controlling the price, they're the highest bidder. It seems like a positive anyway - existing owners can sell at a high rate, government can get more tax, more tax can fund more support for the poor

The current owner can no longer afford the taxes and is forced to sell whether or not they want to. The developer can position themselves as the “highest bidder” by an extremely small margin over the property’s historical value, denying the current owner the windfall from the recent spike in land value. Despite the increased land value, no one else will be interested in purchasing the property at this valuation until the developer’s project is complete, as the project itself is the cause for the spike.

This is effectively eminent domain for private developers. If you’re a homeowner and you’ve been paying your property taxes just fine for the past decade on a $40,000/year salary, you shouldn’t suddenly become unable to afford to live there because someone said you live in a “hot area” or whatever.

Pardon, I don't get this - "The developer can position themselves as the “highest bidder” by an extremely small margin over the property’s historical value, denying the current owner the windfall from the recent removede in land value." - Wouldn't ask/bid and transaction value determine the land value? Why does the land value tax increase a lot if the best offered purchase value will be only slightly higher than historical?

I think that's what they are saying is exploitable. It comes down to who sets the value? Is it all just speculation. Speculation isn't a price tag.

LVT is already a thing in a bunch of places... How come we haven't seen these dramatic gentrifications happen?

For existing houses the investors might very well overbid the market price to get the lot, thereby making it inaccessible for any individual to realistically buy. They'll gladly overpay the market price on adjacent lots so they can "regenerate" the area, by stuffing four houses into two lots. Any individual simply wanting to buy the existing lot is out of luck, because it wouldn't ever make sense for them to overpay the asking price.

For new lots, it works so that whenever a city council decides to change the zoning of a lot of land to allow for residential construction, the price is set for investors to bid on. The entire lot is bought by an "investor" or "developer" who will either build on the lot or sell individual parts of the lot for others to build on. There's no risk. There isn't necessarily any work carried out. There's no service provided. It's just paying for ownership at one price, shuffling the papers and selling at a higher.

It's the same fucking thing as scalping, only over longer time and for larger amounts.

So the idea that "If it's so easy, why doesn't everybody do it?" or "It's fair, because they paid above asking price, you could just have bid higher" is wrong because I for one can't afford to buy ten fucking houses just to get one of them at the right price.

This is how capital accrues.

I don't enjoy the whole foreign investor solution, I think it's a scape goat.

It matters little to me if the person fucking me was born in China or 10 miles from me. Being born in this country doesn't mean you can screw over the rest of the population.

I'd rather see hard limits on how much property one can own. There is no reason for anyone other than the state to own those huge apartment complexes. Dismantle the land barons class, no one should own enough to house thousands.

I think a less heavy-handed way of doing that is, every person can have 1 (one) permanent residence, and all other property you own incurs a much higher property tax. If you're filthy rich and want a couple of houses, fine, but you're gonna get taxed for it. But that will stop speculative house buying, more or less. Of course, this will never happen because states race to the bottom to offer low taxes to attract rich people. Another issue is, what if someone wants to live in a house but can't afford to own it? Renting is the best option for a lot of people. I think that is solvable, but my idea would inevitably take a lot of property off the rental market.

I don't think it is a scape goat. For example, many people from China are not trusting Chinese Yen, they often purchase property purely to hold value and won't even rent it to others, because it would cause wear and tear. So it is basically a wasted unoccupied unit.

As for your suggestions I totally agree.

Americans do this with property too. If we only regulated foreigners from doing it, that would allow american investors the opportunity to do it more beduase they have less investors to compete with.

If you allow foreigners (keep in mind that those who do this, but only are very rich in their countries, but also are very rich compared to you or me) to purchase property now you not only have demand created by locals but you are adding foreign demand. This all drives the price up.

Even if Americans would do the same thing the prices would be still lower, because now they are out priced.

How much property is owned by foreigners paying taxes while not collecting rent? That sounds nuts compared to just holding the dollars they'd use to buy the house in an offshore bank.

The house price just fluctuates continuously and when the "investor" or "scalper" purchases it, it was available at that price for everyone.

That doesn't mean everyone (or people who needed it) have the ability to purchase it. The down-payment is simply too high that most people who want a house cannot afford it.

This is the same as scalping other goods, they have a unfair advantage in the market, and then they can make back all their money via rent and selling the house. They have nearly no way to lose in this game.

The unfair advantage is what making people angry; they are not making money by labor, insight, or even luck. The only reason these people are becoming richer is because they started rich.

I absolutely agree with your solution BTW, just arguing that people scalping houses are very much brain-dead scalpers. Many of them probably don't even care about the basic human right to shelter.

restricting corporations from purchases, banning Airbnb (yes, they drive prices up, and if you use them, you are contributing to it), penalizing if unit is not occupied (though enforcement of this will be hard), or banning foreign investors.

Agreed, we should be doing all of those things. Corporations should not be able to own any kind of housing at all, and multi unit buildings should be under non-profit co-ops.

And to penalize unoccupied housing, we should have a georgist taxation system.

The only time it makes sense for me for a corporation to own a residence is if they have a need to put up their own employees in that area regularly, or if I needed a manager living on site (like some storage facilities have). Corporations should not make their money renting or buying/selling single family homes.

I don't think there are enough such edge cases for it to make sense for it to be legal.

If a corp needs an employee to be that close, then they should hire local, and/or rotate staff.

At a bare minimum, I agree, no corp should profit off of housing.

I'm not sure I'd agree that corporate ownership is necessarily bad If you want to rent an apartment because you don't want to buy into a co-op then how do you go about this? Someone needs to own the apartment to rent to you Personally I don't mind if that initial investment comes from a person or a corporation

Could you rent from the co-op at cost without buying into it?

That's how a lot of co-ops works. Or maybe it's called non-market rental. I don't remember the exact name but it's definitely a thing.

Either way, landlord parasites are not needed.

Who are you paying? Other owners of the apartment? So they put in extra up front so they can rent to you? If so do you get to pay back their initial investment over time? If it's non profit does that mean they can't take anything in excess of what they paid or do they get payed x amount over the top?

I'm fine with co-ops generally but when it comes to rentals I just don't see how you'd make a "not for profit" rental But I mean if someone wants to set one up and prove me wrong that'd be cool. In theory nothing is stopping them

I was actually asking a question. So anyhoo I just Googled it and it's called a "zero equity co op" if you're curious.

The house price just fluctuates continuously and when the "investor" or "scalper" purchases it, it was available at that price for everyone

The goods from manufacturers are available at that price for everyone too, right?

And then as another commenter said, sometimes down payments on housing are outside the budgets of certain groups in society - a point I suppose you can also make for the manufactured goods too.

I think the difference with the first 5 is that a manufacturer sets the price, scalpers purchase it by that price and sells it at a much higher one.

I don't see the difference here with housing. If a real estate owner buys a property then sells that property for higher than they purchased it, the market will either respond by buying or not. The same is true for manufactured goods: if the price set at MSRP doesn't not elicit a response from the market, then the manufacturer may lower their prices until a response is drawn - or hold out until the rest of the economy shifts (a gamble on the part of the manufacturer).

I don't think your reasons substantiate your claims.